Project Overview

My Role: Lead UX Researcher

Duration: 1 Month Sprint

Users: Cross-Functional Internal Teams & SMEs

Request Origin: Office of the CTO

Team: UXR Interns, Data Scientist, Senior UXR (Christina), UXR Manager, UXD Manager, Chief of Staff of Devices & Customer Experience, and VP of Command Center Software

The project focused on the Quote to Cash (Q2C) process for Premier One, VESTA, and MV (Single vs Bundled) products. The goal was to identify and understand the root causes of issues in the Q2C process, which had been causing customer dissatisfaction for several years.

Research question examples:

What is the current quote to cash journey?

How long does it take? Why?

How extensive are the challenges from quote to cash?

Where do the issues stem from?

What can be done to resolve the issues going forward?

Research Plan and Methodology: The research methodology included descriptive, diagnostic, predictive, and prescriptive stages. It this included:

Analyzed 11 data sources (Sales, Financial, Analytics, etc.)

Interviewed 27 subject matter experts across a wide spread of cross-functional internal SMEs

Analyzed 2 customer survey results, including verbatim feedback

Goals & Objectives

To address these issues and enhance product offerings, the team conducted foundational user research to map the entire customer experience journey, identified key touch-points, and uncovered deep insights into user needs, expectations, and challenges.

Goals

Develop a comprehensive understanding of the end-to-end customer experience journey for the software products.

Align product features with user needs and expectations.

Improve overall user satisfaction and retention rates.

Optimize resource allocation in product development.

Objectives

Map the customer experience journey:

Identify all touchpoints between users and the software products.

Document the user's actions, thoughts, and emotions at each stage of the journey.

Analyze and synthesize research findings:

Identify common patterns and themes in user behavior and feedback using Grounded Theory.

Prioritize user pain points based on frequency and severity.

Create user personas and journey maps to visualize the findings.

Develop actionable insights:

Generate a list of at 20+ specific recommendations for product improvements.

Identify 3-5 key areas where the product can better meet user needs.

Share findings and recommendations:

Present research results to key stakeholders within 2 weeks of completion.

Develop a detailed report outlining the research methodology, findings, and recommendations.

Share research insights through reports and actionable insights tracking documentation for Project Management.

Research Methods

Quantitative Analysis

Explanation: Investigated sales and supply chain data to uncover process insights and potential pain points.

Rationale: Provided quantitative insights into the duration of the deployment process, identified which steps took the longest, and determined when contracts started lagging.

In-depth Interviews

Explanation: Conducted one-on-one discussions to explore individual experiences and motivations in detail.

Rationale: Gained deep insights into user behaviors and uncovered complex issues.

Focus Groups

Explanation: Facilitated group discussions to gather diverse perspectives and observe social interactions.

Rationale: Generated ideas and analyzed how group dynamics influenced decision-making.

User Surveys

Explanation: Developed and distributed structured questionnaires to collect data from many participants.

Rationale: Quickly gathered broad, quantifiable insights to validate findings and identify trends.

The Process

Planning

The team developed a comprehensive research plan, outlining the objectives, methodologies, and timeline. They identified key user segments and determined appropriate sample sizes for each research method. The team also created interview guides, survey questions, and focus group protocols to ensure consistency across all data collection efforts.

Recruitment

Researchers leveraged existing user databases and employed screening surveys to identify suitable participants. They sought a diverse representation of users across different software experiences and year of most recent deployment. The team also arranged and managed the scheduling of interviews and focus groups.

Research Execution

The research team conducted in-depth interviews with users, exploring their experiences, needs, and pain points throughout the software product journey.

They facilitated focus groups to encourage discussions and uncover shared experiences among users.

Additionally, the team distributed online surveys to gather quantitative data on user satisfaction, preferences, and sales process and deployment metrics.

Data Analysis

The research team took a rigorous and multi-faceted approach to analyzing the collected data.

Researchers transcribed and coded qualitative data from interviews and focus groups, identifying recurring themes and patterns. They performed analysis on survey responses to quantify user sentiments and behaviors. The team then synthesized findings from all research methods to create a holistic view of the customer experience journey.

Qualitative Data Coding

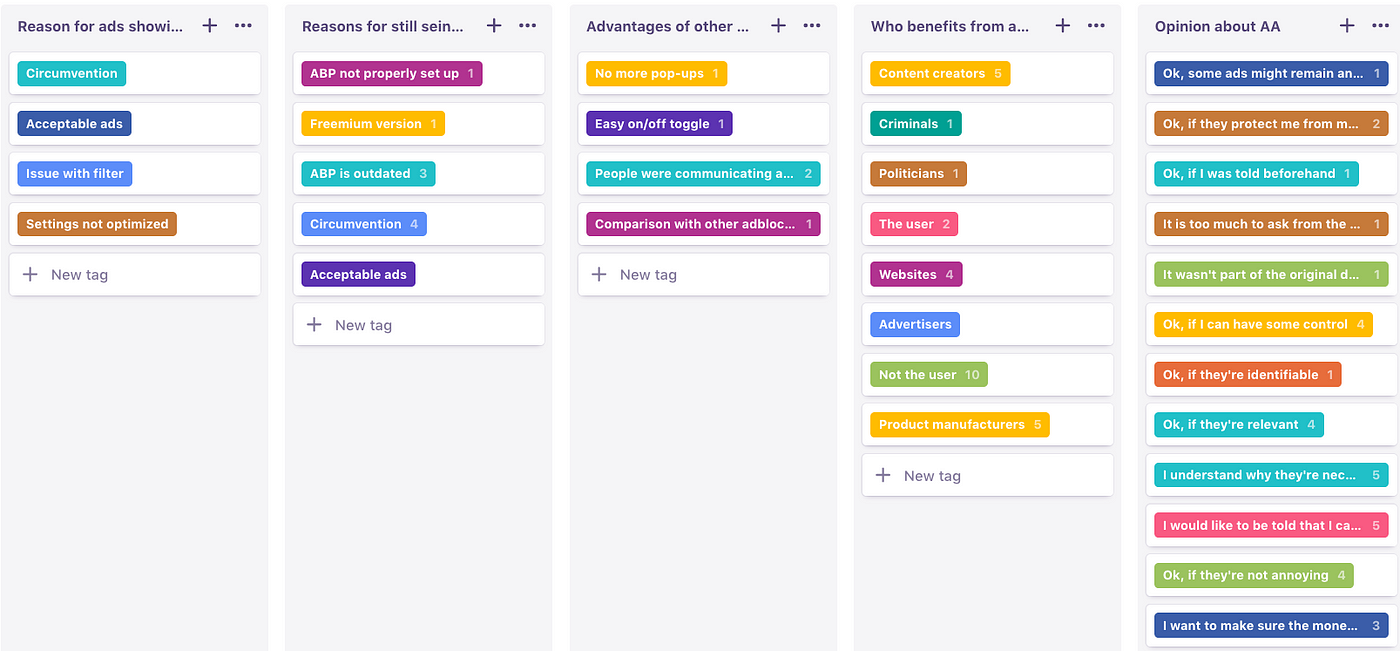

The team also utilized a thematic analysis approach for coding the qualitative data. They began with open coding, assigning initial codes to raw data, then progressed to axial coding to identify relationships between codes. Finally, they performed selective coding to develop core themes. The team used Dovetail, a qualitative research software, to manage and analyze the coded data efficiently

Affinity Mapping in Figjam

Researchers conducted collaborative affinity mapping sessions to organize qualitative data into themes. They used large whiteboards and sticky notes to visually group similar user comments, behaviors, and pain points. This process allowed the team to identify overarching themes and patterns across the user experience journey.

Key Findings & Insights

Q2C Journey:

Contract and Invoice Complexity: A one-to-many relationship between active contracts and invoices is a primary driver of customer dissatisfaction. For example, one particular County Sheriff's Office has 38 active contracts and 83 invoices.

Order Issues: Difficult quoting and order entry systems lead to manual workarounds and order changes.

Invoicing & Billing: Customers rated invoicing and billing as the least satisfactory touchpoint. 89% of customers had negative feedback on their invoicing experience, with concerns about billing accuracy and timeliness.

Themes within billing accuracy include customers having trouble interpreting invoices, receiving incorrect bills, and invoices sent to the wrong address.

Themes within billing timeliness include delayed billing, receiving multiple bills, receiving bills before the product arrives, and short payment terms.

Cycle Time: Cycle times vary across products, with implementation often taking the longest. For example, Project Initiation to FSA for P1 takes 729 days.

Impact on Customer Experience:

Invoicing and billing has consistently been identified as the top driver of dissatisfaction.

Customer feedback on SW Upgrade Agreements includes the need for change management, pricing transparency, and support/upgrades.

Billing issues can lead to frustration, financial implications, and erosion of confidence in the software provider.

Pain Points & Root Causes:

Pre-Sales: Mixed CPQ landscape and lack of customer info.

Ordering: Mixed order management landscape and surging change orders. Most Vesta orders require modification.

Deployment: Handoff challenges and siloed product teams.

Billing/Invoicing: Multiple invoices and non-descriptive invoices.

Renewal/Expansion: Voice/SOT to customer and add-ons & upgrades.

Business Impact

Overall, the research indicated significant opportunities to improve the quote to cash process, enhance customer experience, and streamline business operations.

Proposed Actions:

Pre-Sales: Drive for Northstar "Install Base + Quoting System".

Ordering: Refine pre-sales to ordering handoff detail and improve channel partner processes.

Deployment: Develop deployment playbooks and scalable infrastructure.

Billing/Invoicing: Clarify and consolidate invoices.

Renewal/Expansion: Assign CSA early in the account and converge renewal accounting silos.

Recommendations:

Standardize order change communication and integrate all products in CPQ.

Implement a project management system for cross-team communication.

Address system limitations that cause contracts and subscriptions to be billed separately.

Consider investing in a more flexible and adaptable system.

Learning & Reflection

Looking back, I learned substantially. A few things I look back, reflect, and would change include:

Selectively limit the deployment journey content: This includes establishing the metric of “Duration” from the start and considering visual communication concepts in the final report.

Consider 1:1 interviews instead of focus groups. The method of focus groups were selected to save time during initial stages. However, it created a new set of complexities when conducting analysis and sharing individual insights per software.

Incorporate quantitative data team sooner. Tying together the qualitative and quantitative details was no easy task. While it was a cross-functional bonding moment, the extended hours could have been avoided.